Confused about the Economic Injury Disaster Loan, EIDL Advance, and Paycheck Protection Program? Here’s a great article contributed by Kathy Dise, President of BudgetEase Bookkeeping, to get you through it quickly and be prepared.

Kathy also sent us a sample application for the PPL loan that she noted is subject to change. Kathy also wrote, “The application will give you an idea of what information you might want to have ready. You can apply for the Advance but nothing else now to my knowledge. Processes should be in place with SBA and Banks in the next 5-10 days”. Download the application here

COVID – Loans update – as of March 31, 2020

Is how you are going to get through the COVID-19 crisis on your mind right now?

What can you do now? If you are in need of funding asap, apply for the EIDL Advance(limited to $10,000)* with its 3 day funding. It is not forgivable but can be converted later to a PPL. As of this morning banks are still working out loan application logistics. Many will have online applications soon. If you want to prepare now, have ready:

• Your most recent IRS Form 941 – Quarterly Federal Income Tax Return

• Breakdown of your January 2019 – February 2020 payroll expenses (if you employ 1099 contractors, please include them in this report, but as a separate line item – we are still waiting on clarification as to whether we get to count this expense)

• Year End Financial Statements (2019) – Income Statement and Balance Sheet

Best practice is to segregate your COVID-19 expenses (including payroll, ER health insurance payments, ER retirement plan contributions, rent, interest and utilities starting February 15, 2020 until June 30, 2020) using classes, if possible.

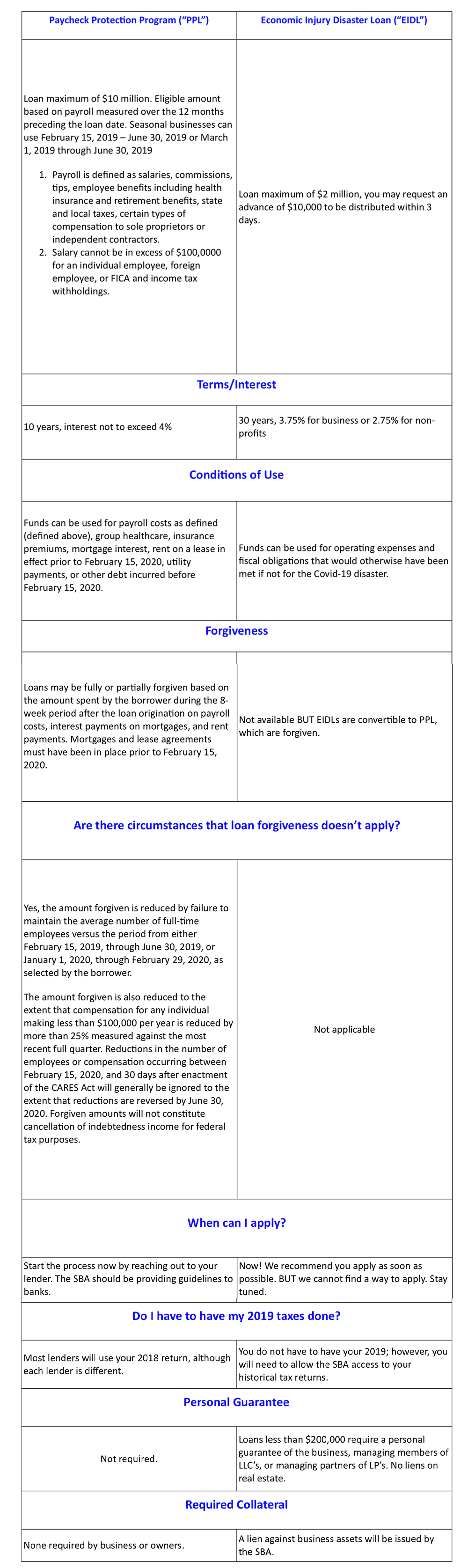

There are two loans available right now that we can help you navigate. Below outlines each loan, the Paycheck Protect Program and Economic Injury Disaster Loan, and how they differ.

It is important to note that you cannot have both loans at the same time. If you receive an EIDL loan you can still apply for a PPP loan. Once you receive the Payment Protection Program loan you can refinance your EIDL loan into it.

Economic Injury Disaster Loan (EIDL) – Applying for a Small Business Loan – Initially borrowers were directed to apply for loans via the SBA website. As of March 31, 2020, the website only has an application for the $10,000 advance – maybe. We have applied but are not 100% sure we will be funded because the application process did not include any normal loan information.

*If you wish to apply for the Advance on your EIDL, please visit SBA site as soon as possible to fill out a new, streamlined application. In order to qualify for the Advance, you need to submit this new application even if you previously submitted an EIDL application. Applying for the Advance will not impact the status or slow your existing application.

Contact us at www.budgetease.biz to find out how we can help you through the loan process, help you clean up your books if you are not currently a client or help you keep track of your COVID-19 allowable expenses for forgiveness.

Contact us at www.budgetease.biz to find out how we can help you through the loan process, help you clean up your books if you are not currently a client or help you keep track of your COVID-19 allowable expenses for forgiveness.

Follow Us!